new mexico gross receipts tax exemptions

Also claim a 2800 tax credit. Employees who have income that is exempt from New Mexico tax for the state under the Combined Reportexample Native Americans working and living on their tribal land.

A Guide To New Mexico S Tax System New Mexico Voices For Children

Payment of applicable taxes including state gross receipts tax and city lodgers tax.

. The tax package known as House Bill 163 also reduces the gross receipts tax rate for the first time in 40 years and includes tax rebates of up to 500 a. Once the total amount of leased vehicle gross receipts tax credited with respect to a vehicle for which payment of the motor vehicle excise tax is suspended pursuant to Subsection A of this section equals or exceeds the amount of motor vehicle excise tax due on that vehicle or the owner has paid the difference pursuant to Subsection D of this section the secretary shall. Thats because the Tax Cuts and Jobs.

Also review Schedule D of the federal income tax return. A lot more people will now be qualifying for the child tax credit that probably did not in the past Orsolini says. Compliance with covenants that prohibit short term rentals.

The tax relief bill also would give 1000 credits to full-time hospital nurses for the 2022 tax year and slightly reduce the state gross receipts tax on retail sales and business services in two. Tax Credits Payments. Several tax breaks can benefit parents come tax time.

Businesses that sell or lease goods and other tangible property or perform services in New Mexico may be subject to New Mexico gross receipts tax. Military members with income from active duty military service should not have New Mexico tax withheld. Unlike a sales tax a gross receipts tax is assessed on businesses and apply to business-to-business transactions in addition to final consumer purchases leading to tax pyramiding.

The Tax Cuts and Jobs Act in 2017 overhauled the federal tax code by reforming individual and business taxes. Total Tax Pre-Credits Total Owed Tax. Additional Medicare Tax - A new 09 Medicare surtax on wage income over a certain income threshold 250000 for MFJ 20 Maximum Capital Gains Tax - A new capital gains tax rate for capital gains income over the highest tax bracket 450000 for MFJ We.

The combination of your gross income any tax-exempt interest and half your Social Security benefits is more than 25000. Material differences should be analyzed. The same goes for those who sell research and development services performed outside New Mexico when the resulting product is initially used here.

The legislation would amend a statute that excludes receipts from launching operating or recovering space vehicles or payloads in New Mexico from gross receipts taxes. Reconcile the differences if a taxpayer has acceptable records but gross receipts recorded in the books and reported on sales and use tax returns do not agree with gross receipts on the federal income tax returns. Exemptions and Deductions New Mexico income tax filers of any age may claim a deduction for the prior tax years unreimbursed and uncompensated medical expenses not already itemized on the federal 1040 return.

It would clarify that. New Mexico Gross Receipts Tax If you are self-employed run a business out of your home or work for someone else but do not have wage taxes withheld you may be required to register for gross receipts tax with the Department. Including the city permit number in all advertising.

The tax is imposed on the gross receipts of businesses or people who sell property perform services lease or license property or license a franchise in New Mexico. Employees with exempt income should indicate exempt on line 7 of the pre-2020 W. Married filing separately with kids.

Determine if the difference is the result of taxable or nontaxable sales. City regulations cap the number of short term rentals at 1000 units in residential zoning districts and limit short term rental units to no more than than two adjacent houses on residential. This deduction is As a New Mexico resident at least 65 years old you may claim special in-come tax and.

New Mexico Lawmakers Ok Crime Bill 500m In Tax Rebates Health Starherald Com

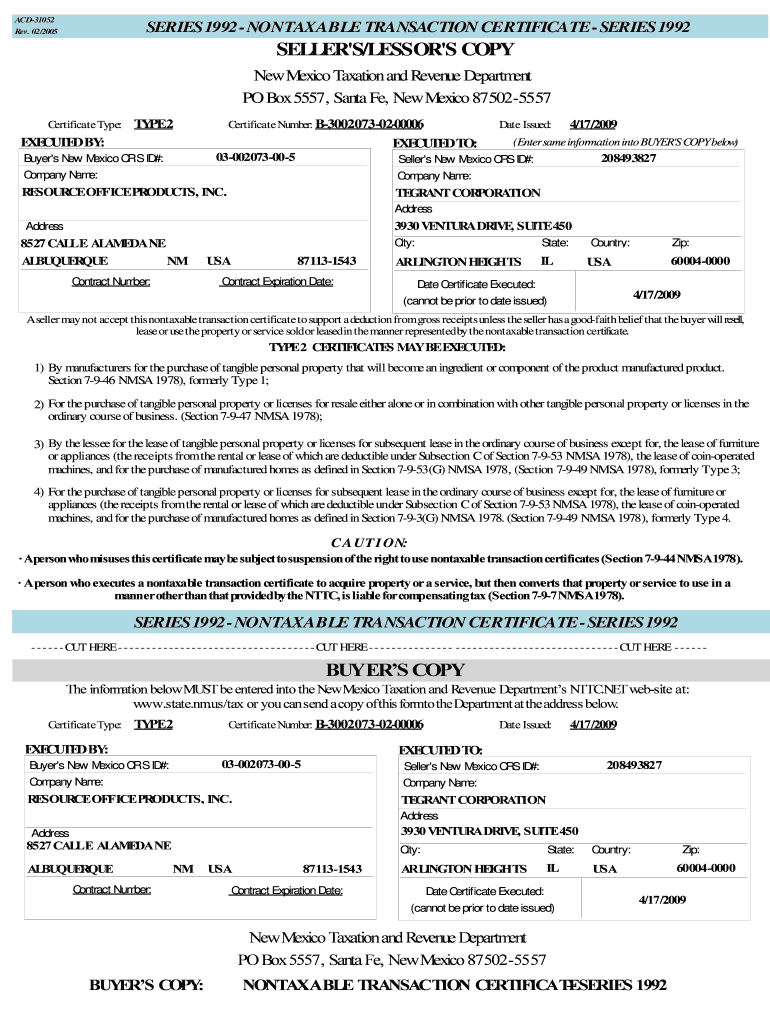

Nm Acd 31052 2005 2022 Fill Out Tax Template Online Us Legal Forms

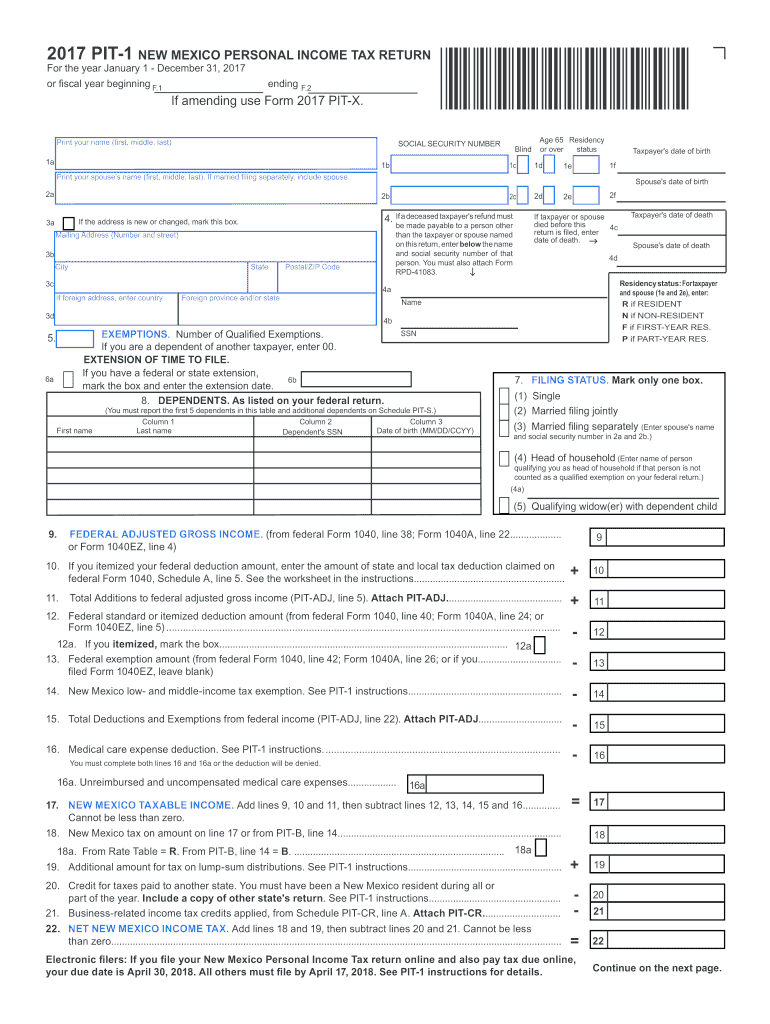

2017 Form Nm Trd Pit 1 Fill Online Printable Fillable Blank Pdffiller

A Guide To New Mexico S Tax System Executive Summary New Mexico Voices For Children

A Guide To New Mexico S Tax System New Mexico Voices For Children

New Mexico Sales Tax Guide And Calculator 2022 Taxjar

New Mexico Sales Tax Small Business Guide Truic

How To Get A Non Taxable Transaction Certificate In New Mexico Startingyourbusiness Com

New Mexico Governor Slashes Taxes As She Pursues Reelection Govt And Politics Oanow Com

New Mexico Gross Receipts Tax Nmgrt Law 4 Small Business P C L4sb

How To Register For A Sales Tax Permit In New Mexico Taxvalet

Lawmakers Taking Cautious Approach To Plan To Cut Grt Albuquerque Journal

Greater Gallup Economic Development Corporation Taxes

A Guide To New Mexico S Tax System Executive Summary New Mexico Voices For Children

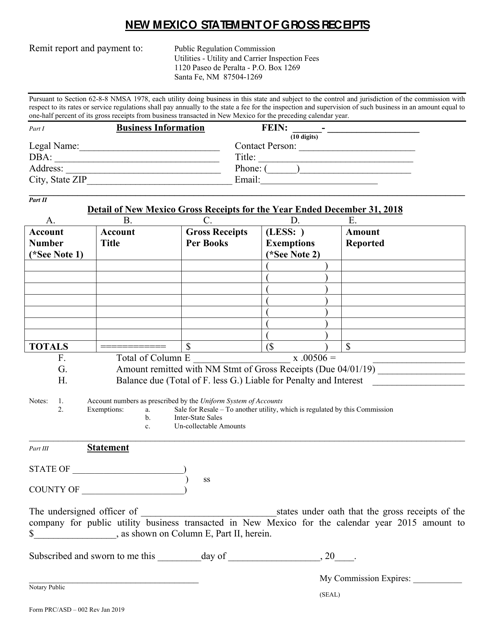

Form Prc Asd 002 Download Fillable Pdf Or Fill Online New Mexico Statement Of Gross Receipts New Mexico Templateroller

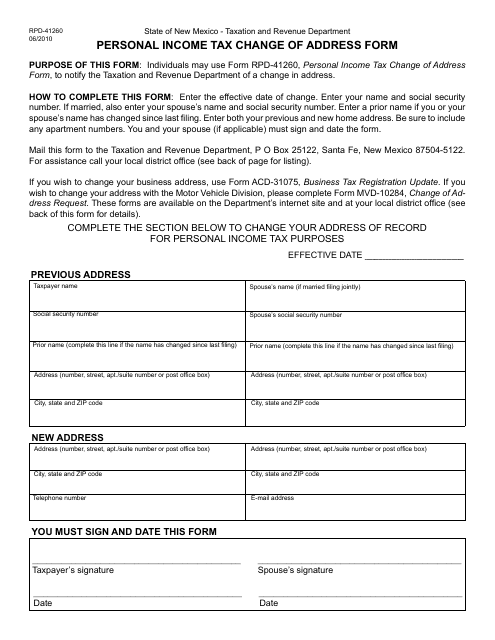

Form Rpd 41260 Download Printable Pdf Or Fill Online Personal Income Tax Change Of Address Form New Mexico Templateroller